Years ago, I explained to a prospective client that my annual fee to manage her portfolio would be 1% of the portfolio. She replied, "why would I pay that when I don't pay anything for my mutual funds." Unfortunately, this public ignorance of what investors pay their retirement advisor is pervasive. In fact, you'd be shocked to know that even executives at companies don't know what they pay to have their 401k plan handled. Spectrem Group surveyed plan sponsors and found that even half of the executives with plans of $50 million and more did not know how their representative was paid.

Here's how your retirement advisor IS paid.

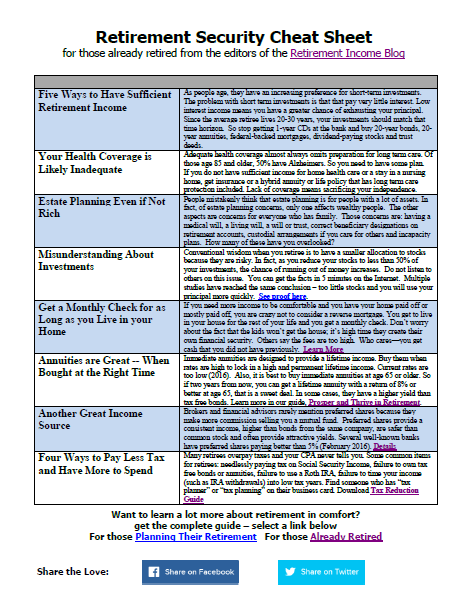

1. If you own mutual funds, the funds are likely load mutual funds which means you paid a fee when you invested (typically 4%) AND you pay an annual fee for management and distribution likely about 1.75% of the total. Alternatively, you paid no upfront fee and pay an annual fee of 2.25% (including management and 12b-1). Note that these fees are fully disclosed in the prospectus but few people ever read it. Not disclosed in the prospectus is the "slippage" cost which occurs when a mutual fund buys and sells large blocks of stocks. This costs the average stock fund investor another 1.2% annually.

2. You may also own mutual funds in a fee-based account. If these are "institutional class funds" such as DFA or Vanguard, your mutual fund management costs are much lower. There is no font end or back end load. The mutual fund does have internal fees approximating .25% annually. On top of this, your retirement advisor likely charges a fee for managing the mutual fund portfolio of 1% for a total annual cost of 1.25%. Slippage costs in these funds are minimal because institutional class funds do little trading.

3. Additionally, you may pay your advisor fees for planning on an hourly or project basis (e.g. for a retirement plan). These fees may be from $100 to $250 an hour and are fully disclosed to you. By law, a retirement advisor that gets paid fees directly by you (as opposed to situation #1 above where the fees are buried in the mutual fund share price) must disclose them clearly.

If you are confused, ask your retirement advisor to put the TOTAL costs of your investments in writing. Ask him to enumerate:

1. the front end load or commission paid upon entry into the investment

2. the back end load or commission when selling the investment

3. the annual ongoing management fees and 12b-1 fees

4. advisory fees paid directly to the retirement advisor

If you don't get a document you can clearly understand, change advisors and ask for this disclosure before investing.

I think the only time you do not pay fees is when you buy stocks on own. You still pay broker cost to buy them but if you hold them and they pay dividends you have income. I still like to have some funds and etfs so i have more companies for the money i invest. This way i reduce risk.