Most people realize that they should save money for retirement. However, the question is 'How much to retire'. When it comes to retirement savings, how much to retire depends on your projected costs, projected guaranteed income, projected inflation, and numerous other elements. So, if you are considering your upcoming retirement needs, let's attempt to response the query of 'How much to retire.'

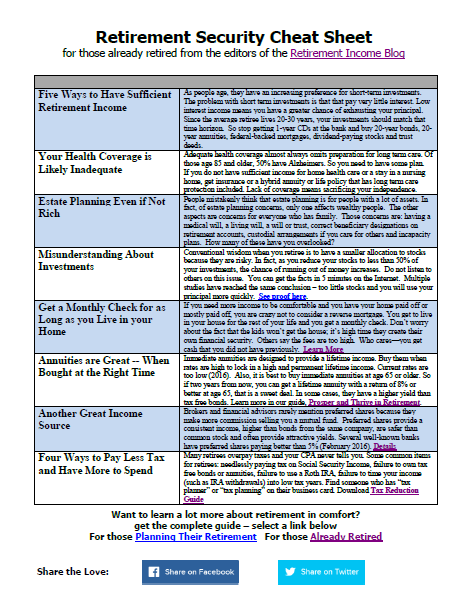

As mentioned, when attempting to reply the question of 'How much to retire', you need to think about your forecasted expenses. Consider what you would like to do during retirement. If you have plans to travel, buy deluxe goods, or prepare for any other non-necessities, take these into consideration. Also, be aware of estimated healthcare expenses (a rule of thumb is $250,000 in out-of-pocket expenses). If you have any severe health conditions or foresee developing them later in life (for example, if you've had a number of family members who've developed heart disease during retirement, it's really worth thinking about this as a potential expenditure), this may make that number higher. On the other hand, in case your family has a history of outstanding health and also you are in excellent health today, your expenses might be reduced than that. Keep in mind that you'll most likely need to spend for medical health insurance premiums by yourself when you retire in the event you want to have private medical insurance. Also, take your potential tax situation into account when responding to the question of 'How much to retire.'

Next, think about your possible supplies of guaranteed income when questioning 'How much to retire.' Take your estimated Social Security revenue (this is assured - for the time being) by using your annual Social Security statements and/or a calculator. Additionally, consider any pension plans and/or other supplies of secured income that you plan to have during your retirement years. Factoring in these supplies of revenue should help you answer the question of 'How much to retire.'

Additionally, when deciding 'How much to retire', consider the projected rate of inflation. Inflation may cause significant deterioration in your retirement savings so it is important to factor this in when determining 'How much to retire.' A simple 1 % increase in the inflation rate can take years off of your retirement revenue. To discover for yourself, make use of a retirement calculator and punch in your numbers.

Eventually, one article cannot provide you with a total answer on the question of 'How much to retire.' It can only help to point you in the correct path. Try utilizing a number of on-line calculators and plug in a variety of numbers to answer the query of 'How much to retire.' Then, when you are able to hammer out the details, consult a financial expert to outline your retirement strategy. Doing this will provide you with a more correct result than every other write-up can probably give you!

Leave a Reply