Let's first state three fundamental principles and then add the details.

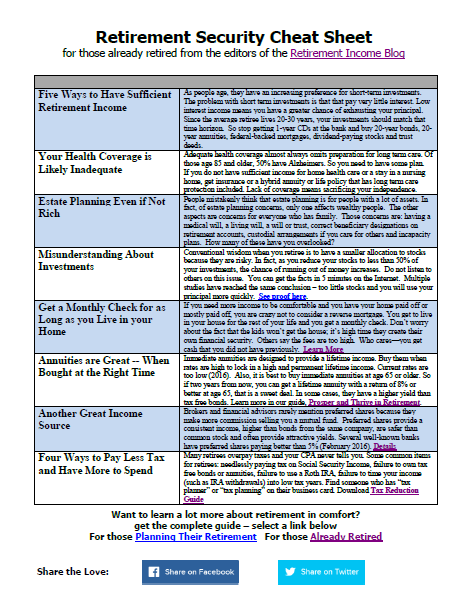

1. Start retirement with sufficient retirement savings

2. Protect your retirement savings from erosion due to taxes and inflation

3. Never lose money

Start with your desired retirement income and expenses. Then, you can use a retirement income calculator to determine how much retirement savings you will need. You need to know how large of a nest egg is required for a comfortable retirement. Most people don't like to do this rigorous exercise of charting your expenses and income over time. If you won't do it, then hire a retirement planner who will. I highly recommend the retirement planning software from J&L planners as it allows you to account for detailed changes in your income and expenses year by year. Only by doing the math do you know how much you need and when you are able to retire.

Next, you need to take advantage of as much tax shelter as possible. For most retirees, that means using your unsheltered money first (e.g. your non-IRA, non-401k funds) . You want to let your tax sheltered money grow as long as possible. The caveat here is the uncertainty of future tax rates. Future income tax rates may be higher than today. You can have a retirement planner calculate for you the tax rate at which it is better to use your sheltered funds first. In fact, understand that the plans you make at the beginning of retirement can change because of changes in tax rates or other variables. That's why smart retirees will update their retirement plan every 24 months.

Last, you need to be sure your principal never declines. That would seem impossible based on the advice in the retirement-Income.net web site that recommends you keep 50% of your funds in stocks and everyone knows stocks go up as well as down. BUT, you will never rely on these stocks for retirement income. Your money will always be in at least 2 baskets—your liquidity basket from which you make withdrawals for your living expenses and your growth basket which replenishes your liquidity basket at long intervals. You will never take funds from your growth basket to live on and the long intervals create a very high probability that you will only have gains in your growth basket between transfers to your liquidity basket. Consider for example that over the last 80 years, when stocks have been left alone for 10 year time intervals, they gained in value 97% of the time.

Of course, in terms of protecting your retirement savings, there may be other asset protection measures such as trust and estate planning that you do for your heirs.

while looking up investment and insurance options for my son, i was struck by the need to save something for myself, for post retirement. Your post gives me food for thought. Will certainly use the retirement calculator and make plans accordingly.

thank you, Oliver.

I think you need to make sure you have some income producting stocks and bonds. This way you can live off the income not principal.

I like stocks that pay dividends or income trust also. This way i have income and it can increase over time not decrease if i reinvest a set amount of the dividends each year.

Best etf funds lists last blog post..Bond etf.

I like some other income sources like real estate for income also. If you follow most retirement plans you will have less and less stock every year so the longer you live the less money you have.

Well my point of view is quite different as I have got solution for retirement income. Retirees should not worry about savings and inflation. They can earn money even after retirement. Retirees should visit to start part time consultancy jobs.