Most people know that they must save for retirement. When it comes to retirement savings, how much you need to retire depends on your projected costs, projected guaranteed income, projected inflation, and various other elements. So, if you're considering your upcoming retirement needs, let's try to answer the query of 'How to plan for retirement.'

When determining how to plan for retirement, consider the estimated rate of inflation. Inflation may cause significant deterioration in your retirement savings so it's important to factor this in when setting s plan for retirement. A simple 1% increase in the inflation rate can take years off of your retirement income. In fact, over 20 years, just an increase from 3% to 4% inflation cuts an additional 18% from what your money will buy. To discover this for yourself, use a retirement calculator and punch in your figures.

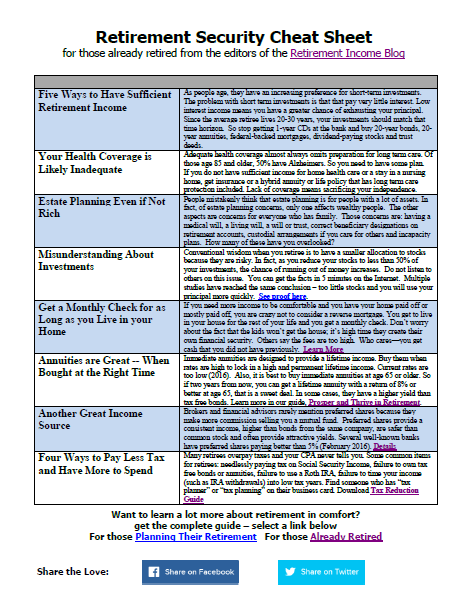

As stated, when attempting to address how to plan for retirement, you need to consider your estimated costs. Consider your preferred activities throughout retirement. If you have plans to take a trip, purchase deluxe objects, or prepare for some other non-necessities, take these into consideration. Also, be aware of estimated health care costs (a rule of thumb is $200,000+ in out-of-pocket medical expenses). When you have any serious medical conditions or foresee developing them later in life (for instance, if you've had several family members who've developed heart illness during retirement, it is really worth considering this as a potential expense), this may make the retirement funds required even greater. On the other hand, in case your family has a background of outstanding health and also you are in excellent health now, your costs might be lower than that. Keep in mind that you'll most likely need to pay for health insurance premiums by yourself once you retire in the event you want to have private health insurance.

Also, take your potential tax situation into account when answering the question of how to plan for retirement. You can find the current IRS tax tables here but it would be wise to add an additional 5% (if the tables show your tax bracket is 20%, assume 25% for the future) as the only way to close the US budget deficit will come from increased income tax rates.

Consider your potential supplies of guaranteed income when figuring how to plan for retirement. Take your approximated Social Security revenue (this is guaranteed - for the time being) by using your annual Social Security benefit statements. Moreover, think about any pension plans and/or other supplies of secured revenue that you intend to have throughout your retirement years. Factoring in these sources of income should help you fill in the amount you will need form retirement savings in planning for your retirement.

Ultimately, one post cannot provide you with a complete answer on the question of how to plan for retirement. It can just help to point you in the correct direction. Try utilizing several on-line calculators and plug in a selection of numbers in calculating how to plan for retirement. Then, when you are ready to hammer out the particulars, seek advice from a retirement planner to outline your final retirement plan.

How to plan for retirement is very interesting topic. Yes, we all need to save more, and from most people I know we haven't saved enough. People are losing jobs left, right, and centre, and are struggling to get by with what money they have today. What we must do is use assets that will give pensions the growth they so desperately need. I'm from the UK and there was a report that pensions had fallen by 75%!!! This was due to fund managers 'expertise'....