Since you're either retired or near to retired, preserving your retirement financial savings while taking a steady revenue from your nest egg could be much more essential than ever before. However, if you're in a high income tax bracket, the federal government might be waiting to take up to 35% of the income you receive from your investments.

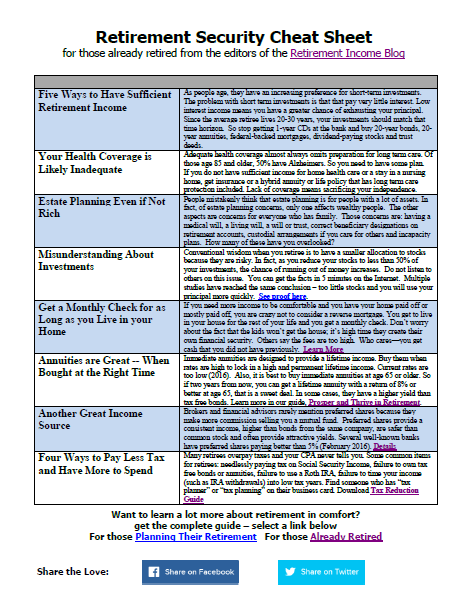

You might consider an annuity in the event you feel best having your retirement financial savings in an asset with a assure. Annuities are deposits with insurance organizations and the insurance company guarantees the account. The earnings aren't taxed until withdrawn thereby supplying tax relief on any profits reinvested type 1 yr to the next. Such businesses as MetLife, Prudential and New york Life made it through the great depression so annuities with this caliber of organization are safe.

With respect to your IRA retirement money, you can also be at the age (over 70½) where you are required to take minimum distributions (RMD). However each year, do you realise you are keeping the money right into a checking account or CD? Even though there is some thing to be explained about security and also the FDIC insurance afforded to these investments, it is essential to also think about the results of income taxes and cost of living. In years where inflation is on the rise, you can find that your 'after-tax' return on these covered investments is not keeping up with the cost of living. In other words, your retirement financial savings is eroding in buying power.

As a practical matter, municipal bonds might provide an alternate and some tax relief since the interest is usually received free of federal, state and local income taxes. This could offer much more income to help meet retirement requirements and preserve retirement financial savings. Of course, there are exceptions to the favorable income tax treatment for taxpayers that are subject to the Alternative Minimum Tax (AMT) or who have purchased municipal bonds outside of their state of residence. You should remember these particular bonds are backed by the credit of the issuing local authorities, and also the principal and yield on these bonds can vary with market circumstances.

Consequently, if your beneficiaries obtain your IRA retirement money, they will have to pay income taxes on their distributions. Assuming that your IRA grows, this implies that the potential revenue tax liability to your loved-ones may also increase. However, beneficiaries who obtain assets that are possessed 'outside' the IRA will obtain them at the reasonable market value on your date of death. In other words, you beneficiaries obtain a 'stepped-up' cost basis on the non-IRA inherited asset. As one example of this principal, you can have mutual fund shares in your Ira that are worth $100,000. Once the funds are held inside an Individual retirement account or other qualified retirement program, your beneficiaries will eventually pay income tax on the entire value of the shares at their respective tax rates.

Nevertheless, if you own the shares outside of an Ira, your heirs might receive and sell the shares without possessing any federal revenue taxes (although federal estate taxes can apply if the decedent's estate is greater than the estate exemption). This is some thing to think about if you're worried about the end-result of your estate program.

Leave a Reply