Among the challenges numerous older traders encounter when retiring is managing their cash flow to supply appropriate retirement savings. Unfortunately, typical stock dividends come with no ensures. Businesses aren't needed to pay them, and people that do can suspend their dividends anytime as their business needs dictate. Because there are no ensures for dividends, should you depend on them when retiring? Possibly, but first think about the next factors.

Initially, create a varied portfolio of distinct dividend-paying shares. If your dividends are coming from a single source, you run the risk of losing what could be a substantial portion of your income should the business determine to discontinue their dividend payments. Retiring with a varied portfolio, your regular dividend income stream could carry on, buffered by the on-going payments of the other stocks in your portfolio. Even though variation does not guarantee against the risk of loss in a decreasing market, it could help to reduce the market volatility risk of your general portfolio.

Second, when retiring and creating your dividend-income portfolio, search for high-quality companies in market sectors which have traditionally paid out a steady stream of dividends to investors. Discovering these stocks isn't challenging and there are a few good places to begin. Businesses in stable sectors or in highly-regulated markets such as electric utilities are usually great candidates for a retirement dividend-income portfolio. These companies generally encounter fewer risks to their business and fewer interruptions of their cash flow, making it less likely they would have to discontinue dividend payments.

An additional way to invest for dividends when retiring would be to select a dividend income fund. A dividend income fund provides diversification in a mutual fund expense. Plus, a fund provides the experience of the professional money supervisor who does the study and chooses the stocks in your part. Take note, nevertheless, that shares and mutual funds are investments that entail market risk, and investment return and principal value will fluctuate so that upon redemption an investor's shares may be worth much more or less than the initial value.

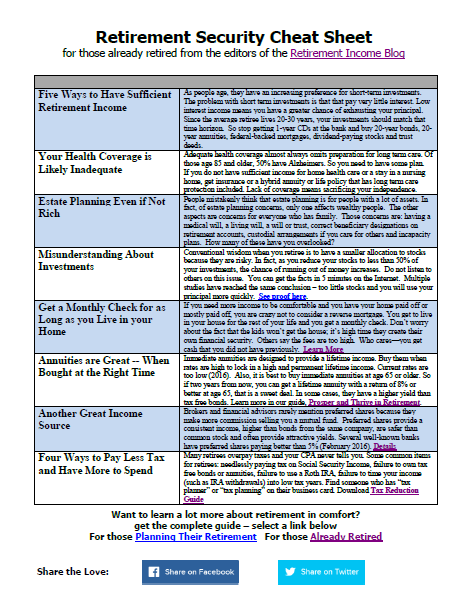

In light of the dangers of possessing stocks of any type, when retiring, dividend-paying shares would be the least risky to possess because they have a tendency to vary less than pure growth stocks. The say that the 'proof is in the pudding' so we've included a chart to sow the outcomes of the hypothetical investor retiring with a basket of the S&P 500 shares. As you can see, their retirement savings would have risen quite consistently over almost four decades.

Leave a Reply