As an investor and trader I always have the emotional challenge of sticking with the long-term fundamentals and technicals and fighting myself to ignore short-term trends. For those with an interest in gold, the signals are compelling to be on the short side of the trade. But will this serve your long-term goal of why you are bullish on gold in the first place?

It is likely that you invest in gold as a hedge against the devaluation of paper currencies. This is a sensible and powerful reason to have a bullish gold position. We all know that it's just a matter of time before the paper currencies experience more damage. As an example, we see only now the Euro getting beaten down and it's been three years of this back and forth nonsense with Greece which should have driven the euro down long ago. It's only in relation to the euro, that the US dollar looks any good. As more and more investors wake up to the fact that few paper currencies are any good, gold will have its day.

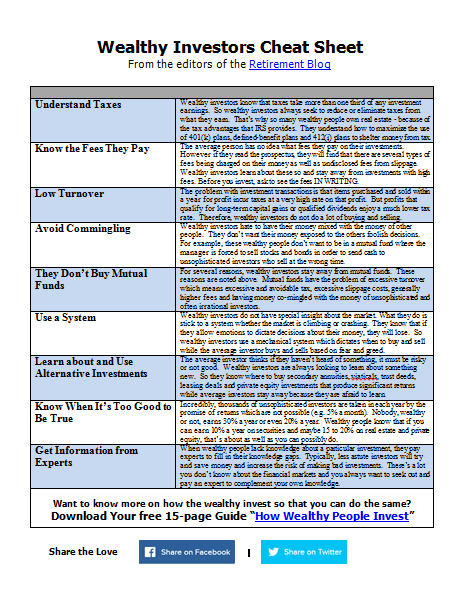

So I've included the two charts below is a reminder to ignore the short term and stay the path. The first chart shows the short-term trend and when you combine that with all the bearish talk you could certainly be inclined to sell. The bottom chart shows why you should stay with your convictions. I hope this short post helps remind you of your long-term goals and solid reasons for investing in gold.

Leave a Reply