You are at the phase where you can stop working or not, but when to retire? A newly released study has found five trade-off situations that have an affect on an employee's decision to stop working or not. Let us review the results of those effects and also the retirement options.

Health Insurance Coverage effect

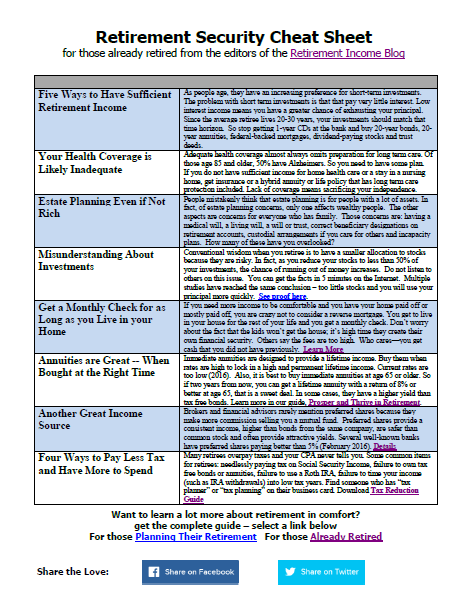

If you are wondering when to retire, be advised that health insurance has a big impact on the retirement decision. Health coverage that is paid for through your continues employment strongly discourages retirement. And for this sole reason, many continue to work when they could otherwise retire. However, alternative sources of health insurance, such as employer-sponsored retiree coverage, spouse's health coverage, public health options (e.g. Medicare) motivate an earlier retirement age. Don't forget to look into health coverage form various professional associations or groups that you could join.

Increase retirement wealth versus prospects for great work earnings effect

Employees who've experienced substantial increases in their prosperity - in both retirement plans, retirement savings, housing equity, or other wealth classes - choose when they retire earlier rather than later. On the other hand, when they see great earnings prospects that suggest a high opportunity cost for retirement, they have a tendency to continue working. This is particularly true of those with specialized knowledge that can consult for attractive hourly rates.

Defined Benefit plan vs . Determined Contribution strategy impact

Whether or not you have a Defined Benefit (DB) plan (the most popular of pension plans) or Defined Contribution (DC) plan (most popular is the 401k retirement plan), significantly influences your answer to the question when to retire. Employees who have one of the traditional pension plans are much more likely to retire than those who do not -since the revenue it'll generate is an assured lifetime payment. Alternatively, employees with substantial retirement savings in DC plans, such as 401ks, still have a tendency to significantly delay their retirement age simply because the income stream it could create isn't so aassured (although one could trade the 401k for a lifetime annuity).

Business Cycle effect

Stock market booms associated with the business cycle increase the probability that those will choose an earlier choice in the dilemma of when to retire. An employee looking at an inflated 401k balance or stock portfolio will feel wealthier and better able to navigate retirement. A 'bust' hurts DC programs and is likely to keep this kind of plan owner working longer. They tend to hold off their retirement age to a time when their retirement savings portfolio is on the upswing.

Social Security's Increasing Regular Retirement Age Impact

The decision of what to retire by older employees is considerably linked to Social Security benefits. The ongoing rise in the normal retirement age for Social Security with its associated benefits modification encourages retirement delays.

All of the above factors results impact the risks and rewards of a specific time to retire and the choice of when to retire.

It is really good to be concern with retirement. I just hope that it will be process accordingly. Well, it offers a lot of good things that you may get later on.

Thanks for sharing about this.

Hetty