People entering retirement frequently misperceive the magnitude of their investment horizon and will unintentionally undermine their retirement financial planning. Just how long does your portfolio have to survive? Well, that all depends upon how long you'll live. But that is exactly where the false impression is! How many years will you statistically live?

All of us know that life span is approximately seventy seven. Nevertheless exactly what does that truly imply? As you'll soon observe, this number is misleading and shouldn't be used in your retirement financial planning.

Life-span is determined by a birth year. The lifespan for people born in the year 1900-the turn of the twentieth century-was about 50. That means 50% of the individuals born in 1900 had been expected to live beyond 50, while 50% were predicted to have died before reaching it. So life-span is mathematically the '50/50' age that people will live to. Consequently, even if you use this number in your retirement financial planning and it were the right number to use, you would still have a 50% possibility of living longer and running out of money!

The life expectancy for a individual born in the year 2000-the turn of the twenty-first century-is 77. So 50% of these individuals will live beyond the year 2077. You can see that life span has improved by about 50% throughout the 20th century. Improved medical treatment and health account for most of this.

Now here's the rub.

Initially, these life expectancy values are an average of everyone born in a particular year. Shelf-life has a smaller grain variation according to a person's sex and socioeconomic status. For people born in the year 2000, women's lifespan is 79.9 while men's is just seventy four. Well-off white collar employees will statistically live longer than poorer blue collar employees. How you are in a position to manage your living style and health clearly has an effect on your own life expectancy. So you're not meant to kick the bucket at the 75-year mark! Consequently, your socioeconomic status comes enters your financial planning not only as to your resources and income but additionally its impact on your life span.

Second - and more remarkable-is that the more aged you get, the further beyond your initial life expectancy you are anticipated to live! That's simply because you've survived early death statistics that limited your original lifespan according to your birth year. Not many retirement financial strategies consider that reality: the longer you have existed, the more you will live.

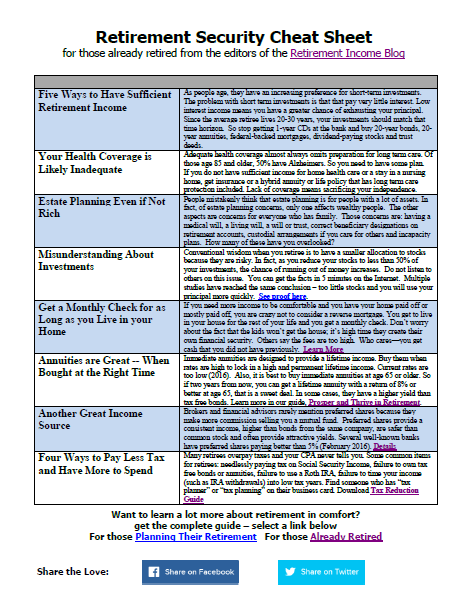

Insurance statisticians keep an eye on this extended lifespan for individuals based on their current age. The IRS publishes its own tables on these. It's called 'the life expectancy factor' that is the amount of years more you need to live-statistically. You have a 50% chance of outliving these too! Look at the table for samples taken from the IRS's table.

| Current age (yrs) | IRS Life expectancy Factor (yrs) | Projected life expectancy (yrs) |

| 60 | 25.2 | 85.2 |

| 65 | 21 | 86 |

| 70 | 17 | 87 |

| 75 | 13.4 | 88.4 |

| 80 | 10.2 | 90.2 |

| 85 | 7.6 | 92.6 |

As you can observe from the above, when you have reached age sixty, you're expected (50/50 chance) to live to age eighty five. But when you achieve age eighty-five, you are expected to live to age 92! How many individuals consider this in their retirement financial planning as to how much time their cash must last?

All this relies on the mathematical fact that retirees have usually a a lot longer investment horizon than they believe. Whenever you prepare-or re-evaluate--your retirement years, make sure to prepare your living style, portfolio, and withdrawal rates to help keep your portfolio robust so it will likely be there as long as you will-statistically!

Naturally, everyone is distinct, as well as your health situation might make a considerable difference.

Leave a Reply