Many economic coordinators will say to you the best way to save for retirement is to begin young and regularly put aside a portion of your salary into a retirement savings vehicle. And several individuals definitely do that. But if you're like most of us, you didn't conserve as much as you can, and now you are searching for some last second retirement options.

On one side, you can save more. However that is not necessarily a plausible retirement options if you're already having problems paying your living expenditures. More immediate objectives, including paying for your mortgage and medical care expenses, or helping out your children and grandchildren, might be stretching your budget. Around 58% of People in America age fifty five and older have less than $100,000 in their retirement personal savings, based on the Employee Benefit Research Institute's newest Retirement Confidence Survey . Just 19% have $250,000 or more of retirement savings.

That means you may have to adjust your early retirement age or consider planning to a less expensive area.

Relocating? To many, that may appear drastic. You love where you live. You have built a life there. You are near to your children and grandkids. But depending on where you live today, and exactly where you move to, it could considerably impact your standard of living and allow a lower early retirement age.

Such a move can even consist of warm climate and palm trees, but most importantly, relocating from a high-cost area to one with a significantly reduced living costs. Doing so could make the main difference between an early retirement age and working for a number of more years - particularly if you have substantial equity in your home that may bootstrap your move. Let's say you have $50,000 a year to live on in retirement, and also you currently live in Oakland, California. What will occur if you relocate to Bradenton, Florida? In accordance to Bankrate.com , you can take a 33.21% decrease in your retirement revenue and nonetheless preserve your standard of living. Just compare a few of the costs between the 2 areas.

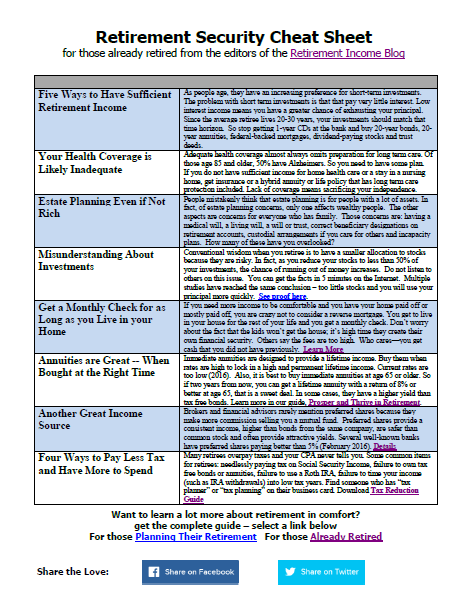

Cost of living comparison

| Oakland, CA | Bradenton, FL | |

| Home price | $669,083.00 | $299,138.50 |

| Mortgage payment | $3,089.74 | $1,370.46 |

| Apartment rent | $1,389.00 | $769.00 |

| Gasoline | $2.94 | $2.81 |

| Doctor visit | $89.80 | $78.50 |

| Optometrist visit | $119.75 | $73.60 |

| Men's shirt | $39.19 | $24.10 |

In fact, there have been only a few things that cost more in Bradenton than in Oakland, including power, which was $120.69 and $167.03, respectively. (Guess it is all the air conditioning.)

The key, if you're considering this technique, would be to discover a community with a strong economic climate in addition to opportunities for an pleasant way of life. The latter will rely on what you enjoy, but may include warm weather, permission to access cultural events, or other retired people with whom you may interact socially. So maybe there's an area that you will like with reduced housing and living costs and can permit you to have the early retirement age you dreamed of.

Leave a Reply